BTC Price Prediction: Will It Reclaim $90,000 Amidst Technical Resistance and Institutional Buildup?

#BTC

- Technical Resistance at Moving Average: Bitcoin's price is currently testing its 20-day Moving Average (~$90,508), which is a critical short-term resistance level. A daily close above this is needed to signal a bullish breakout toward higher targets.

- Strong Institutional Buildup vs. Near-Term Volatility: Major bullish fundamentals like Goldman Sachs' acquisition and MicroStrategy's new capital reserve are countered by regulatory actions and whale-driven leverage battles, creating a volatile but fundamentally supported environment.

- MACD Suggests Consolidation Phase: The negative MACD histogram indicates the current uptrend is pausing or facing selling pressure. A reversal to positive territory would be a key technical confirmation for the next leg up.

BTC Price Prediction

BTC Technical Analysis: Consolidation Below 20-Day MA Signals Cautious Outlook

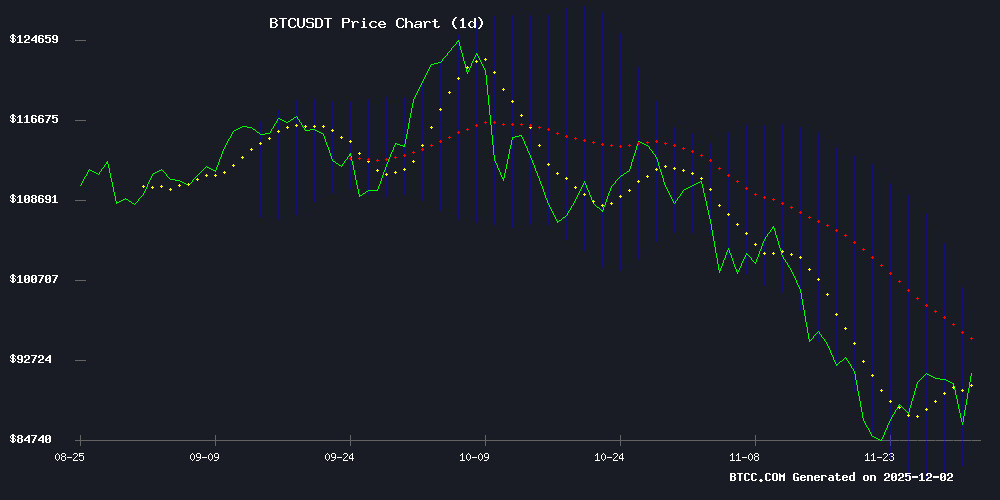

According to BTCC financial analyst Robert, Bitcoin's current price of $90,130.48 sits just below its 20-day moving average of $90,508.43. This positioning suggests the market is in a consolidation phase, testing a key technical level. The MACD indicator, with its histogram reading of -1,807.89, shows bearish momentum is present in the short term, indicating a potential pause in the recent uptrend.

Robert notes that the Bollinger Bands provide critical context. With the price trading closer to the middle band than the upper band, and the bands themselves being wide (Upper: $97,929.85, Lower: $83,087.01), it reflects elevated volatility. A sustained MOVE above the 20-day MA could open a path toward the upper band, while failure to hold support could see a test of the lower band.

Institutional Moves and Regulatory Actions Shape Mixed Market Sentiment

BTCC financial analyst Robert points to a dichotomy in current market drivers. On one hand, bullish institutional narratives are strong, highlighted by Goldman Sachs' planned $2B acquisition of a Bitcoin ETF issuer and Michael Saylor's new $1.44 billion reserve strategy for MicroStrategy. These events underscore accelerating institutional adoption, a fundamental pillar for long-term price support.

However, Robert cautions that these are tempered by near-term headwinds. News of European authorities seizing €25M in Bitcoin and reports of short-term holders facing losses inject caution. The clash of 'Bitcoin whales' in Leveraged battles and Arthur Hayes' reiterated $250K target amidst volatility paint a picture of a market in a high-stakes tug-of-war. The overall sentiment, according to Robert, is cautiously optimistic but acknowledges significant near-term volatility and regulatory scrutiny.

Factors Influencing BTC’s Price

European Authorities Seize €25M in Bitcoin Following Cryptomixer Takedown

Europol has supported Swiss and German authorities in dismantling Cryptomixer.io, a dark web-based platform accused of laundering over €1 billion in digital assets. The operation, conducted between November 24 and 28, resulted in the seizure of three servers, 12 terabytes of data, and €25 million worth of Bitcoin.

The mixing service, operational for a decade, obscured blockchain transactions to facilitate cybercrime. Its dual presence on the clear and dark web made it a preferred tool for criminals seeking to clean funds before exchanging them on legitimate platforms.

Goldman Sachs to Acquire Bitcoin ETF Issuer Innovator in $2B Deal

Goldman Sachs has agreed to acquire Innovator Capital Management for approximately $2 billion, a MOVE that integrates a prominent provider of defined-outcome exchange-traded funds—including a Bitcoin-linked product—into the bank’s asset-management division. The acquisition, slated to close in Q2 2026, will add $28 billion in assets under supervision to Goldman’s $3.45 trillion portfolio.

The deal underscores Goldman’s strategic push into crypto-focused financial products. Innovator’s flagship Bitcoin ETF, QBF, employs FLEX options tied to Bitcoin ETFs or the Cboe Bitcoin US ETF Index, offering investors capped downside risk and 71% participation in Bitcoin’s upside over quarterly intervals. As of last week, QBF held $19.3 million in assets.

This acquisition accelerates Goldman’s expansion in structured crypto exposure, complementing its broader ambitions in tokenized funds and active ETFs. The bank’s embrace of defined-outcome strategies signals growing institutional confidence in Bitcoin’s role as a scalable asset class.

Bitcoin's Meteoric Rise Continues as Institutional Adoption Accelerates

Bitcoin's journey from obscurity to mainstream asset class continues unabated. The cryptocurrency that traded for pennies in 2010 recently reached an all-time high of $126,000 - a 629,900% appreciation over 14 years. Early investors saw returns approaching 190 million percent.

Financial heavyweights including Mastercard and JP Morgan are now accumulating bitcoin positions. MicroStrategy's Michael Saylor maintains his bullish stance despite recent price corrections below $85,000. Arthur Hayes projects $200,000 BTC by year-end 2025.

Regulatory milestones loom as Bitnomial prepares to launch the first CFTC-regulated spot crypto venue in Chicago. The platform will operate under self-certified rules with a 10-day review period.

Analyst Disputes Link Between Bitcoin ETF Outflows and Price Decline

Bloomberg Senior ETF Analyst Eric Balchunas challenges Citi's recent research connecting spot Bitcoin ETF outflows to BTC's 21% monthly price drop. Citi's model suggested a $1 billion withdrawal correlates with a 3.4% price decline, but Balchunas counters that year-to-date inflows of $22.5 billion WOULD imply a 77% gain under the same logic—a scenario not reflected in markets.

November saw record outflows of $3.79 billion from US spot Bitcoin ETFs, led by BlackRock's iShares Bitcoin Trust ($2.47 billion) and Fidelity's Wise Origin Bitcoin Fund ($1.09 billion). The debate highlights diverging interpretations of ETF FLOW impacts on crypto valuations.

Saylor Changes Strategy: New $1.44 Billion USD Reserve Unveiled

MicroStrategy, the Bitcoin-focused treasury company, has announced a significant shift in its financial strategy with the establishment of a $1.44 billion USD reserve. The reserve, funded through sales of class A common stock under the firm's at-the-market offering program, marks a departure from its singular focus on expanding Bitcoin holdings since 2020.

The new USD reserve aims to cover at least twelve months of dividends and interest payments, with plans to extend coverage to 24 months or more. According to MicroStrategy President and CEO Phong Le, the current reserve can sustain 21 months of dividend payments. "We intend to use this reserve to pay our Dividends and grow it over time," Le stated.

This strategic pivot comes as Bitcoin experiences a bearish transition, with prices retreating to the low $80,000 range after peaking at $126,000 in October. Michael Saylor, MicroStrategy's co-founder and chairman, framed the move as an evolutionary step: "Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution."

MicroStrategy's $19B Bitcoin Wipeout Sparks Reserve Diversification Plan

MicroStrategy’s bitcoin bet turned toxic as the cryptocurrency retreated from its July 2025 peak of $119,000 to $86,000. The enterprise software firm—now a de facto bitcoin proxy—saw its holdings evaporate by $19 billion in five months. Its 650,000 BTC stash, once valued at $75 billion, now stands at $56 billion.

CEO Michael Saylor’s unwavering bullishness now faces its sternest test. The company’s average purchase price of $73,000 per bitcoin leaves scant margin for error. With profits thinning to 18%, another market downdraft could push the entire position underwater.

The NASDAQ-listed firm announced a $1.44 billion USD reserve fund to stabilize its balance sheet. This hedging move comes as MicroStrategy shares (MSTR) cratered 54% in six months, erasing all 2025 gains. The stock collapsed from $300 to $171, leaving late entrants holding heavy bags.

Bitcoin Whales Clash in High-Stakes Leverage Battle

Two newly-activated whale wallets have ignited a high-stakes derivatives showdown, placing opposing Leveraged bets totaling over $64 million on Bitcoin's price direction. The conflicting positions are amplifying short-term market volatility as traders watch for potential liquidations.

On-chain analytics reveal a 15x long position worth $25.9 million established at $84,736.9, currently profitable by $505,000. Its counterpart—a more aggressive 20x short worth $38.6 million—entered at $86,373.6 and shows early losses. The opposing liquidation triggers at $72,424 (long) and $92,884 (short) create a tension zone around current price levels.

Derivatives open interest has surged 125% month-over-month as this whale confrontation unfolds. Market participants anticipate heightened volatility, with price swings potentially triggering cascading liquidations in either direction.

Arthur Hayes Doubles Down on $250K Bitcoin Target Despite Market Volatility

Bitcoin's violent retreat to $86,000 has investors scrambling for cover, but Arthur Hayes sees opportunity in the chaos. The BitMEX co-founder predicts a bottom NEAR $80,000 before a parabolic rally to $250,000 by year-end—a call echoing Fundstrat's Tom Lee.

Market mechanics drive Hayes' conviction. He interprets BTC's divergence from equities as a liquidity signal, anticipating Federal Reserve policy shifts will catalyze crypto's next leg up. The current selloff, he argues, represents capitulation before the reversal.

Technical traders note Bitcoin's 30% correction from its $125,000 peak mirrors historic mid-cycle pullbacks. On-chain data shows long-term holders accumulating at these levels, while leveraged speculators get washed out.

Bitcoin Short-Term Holders Face Deep Losses as Market Tests Cycle Lows

Bitcoin's recent downturn has hit short-term speculators hardest, with the 1–3 month holder cohort now facing the steepest losses of this market cycle. Darkfost data reveals these investors—who typically buy during momentum surges—are underwater by an average of $113,692 per BTC, signaling extreme stress among the market's most reactive participants.

Such capitulation historically precedes pivotal turning points. The current drawdown mirrors prior cycle bottoms, suggesting Bitcoin may be approaching a make-or-break support level. With spot and derivatives momentum waning, the behavior of these distressed holders could determine whether BTC stabilizes or cascades into deeper losses.

Why Crypto Underperformed in 2025: Structural Supply and Shifting Narratives

Cryptocurrencies lagged behind traditional risk assets for much of 2025, with Bitcoin failing to sustain breakouts and altcoins bleeding liquidity. The disconnect stemmed from structural supply issues, fading belief in crypto's foundational narratives, and emerging existential risks.

Pseudonymous analyst "plur_daddy" pinpointed ownership concentration as the Core issue. Large OG Bitcoin balances—accumulated over a decade—remained tightly held until 2025, when spot ETFs and deep derivatives markets finally provided exit liquidity. The $100K price region became a gravitational pull for distribution, aligning with the four-year cycle peak and a cultural shift from cypherpunk idealism to institutional commoditization.

Adding to the pressure were quantum computing fears and the psychological weight of holding life-changing wealth in a single volatile asset. The convergence of these factors created a perfect storm for long-term holders to offload positions, leaving the market starved of fresh demand to absorb the supply.

Elon Musk Frames Bitcoin as 'Energy Money' Amid Market Fluctuations

Elon Musk has reignited discussions around Bitcoin's intrinsic value, calling it the 'true currency' due to its energy-based foundation. The Tesla and SpaceX CEO emphasized that Bitcoin's mining process—which ties the cryptocurrency to physical energy consumption—creates a scarcity that cannot be replicated by fiat currencies. His comments, posted on X, came as Bitcoin traded around $86,500, sparking immediate reactions from investors and policymakers alike.

Market observers interpreted Musk's stance as a bullish signal for Bitcoin's role as an inflation hedge. The argument reframes Bitcoin's energy use not as an environmental liability but as a proof mechanism that ensures authenticity. This contrasts with Musk's earlier criticisms of mining's ecological impact, highlighting a nuanced shift in perspective.

Trading desks and crypto outlets dissected the implications, with some investors doubling down on BTC's long-term narrative. Meanwhile, political figures weighed in, underscoring the growing intersection of cryptocurrency and policy debates.

Will BTC Price Hit 90000?

Based on the current technical setup and market news, the immediate move to sustain a price above $90,000 faces a clear hurdle. The price is currently testing the 20-day Moving Average at ~$90,508, which acts as dynamic resistance. A decisive daily close above this level, accompanied by a shift in the MACD momentum, would be a strong technical signal that the consolidation is breaking to the upside, making a sustained hold above $90,000 likely.

The fundamental backdrop provides a supportive floor. Major institutional moves like the Goldman Sachs acquisition and MicroStrategy's continued commitment are powerful long-term bullish signals. However, regulatory actions and the resulting market volatility from leveraged positions could cause short-term dips below $90,000 before a more solid foundation is built.

Key Data Snapshot:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $90,130.48 | Just below key MA resistance |

| 20-Day MA | $90,508.43 | Immediate resistance level |

| MACD Histogram | -1,807.89 | Short-term bearish momentum |

| Bollinger Middle Band | $90,508.43 | Confluence with 20-day MA |

| Bollinger Upper Band | $97,929.85 | Potential target on breakout |

In summary, while the price is flirting with the $90,000 level, a clean and sustained breakout requires overcoming the combined technical resistance around $90,500. The strong institutional narrative suggests any significant pullbacks may be bought into, keeping the overall trajectory biased toward eventually achieving and holding above $90,000.